Ytd federal withholding calculator

Free Federal and Illinois Paycheck Withholding Calculator. The impact on your paycheck might be less than you think.

Filing Status Instructions Select Your Filing Chegg Com

Instead you fill out Steps 2 3 and 4 Help for Sections 2 -- Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit.

. Until they decide to change the math formula to look at YTD Total Gross Wages for each paycheck. Pay Frequency Use 2020 W4. If you have a household with two jobs and both pay about the same click.

They are all using the 2020 W-4 form. Check out the IRS withholding calculator. Payroll Deductions Online Calculator.

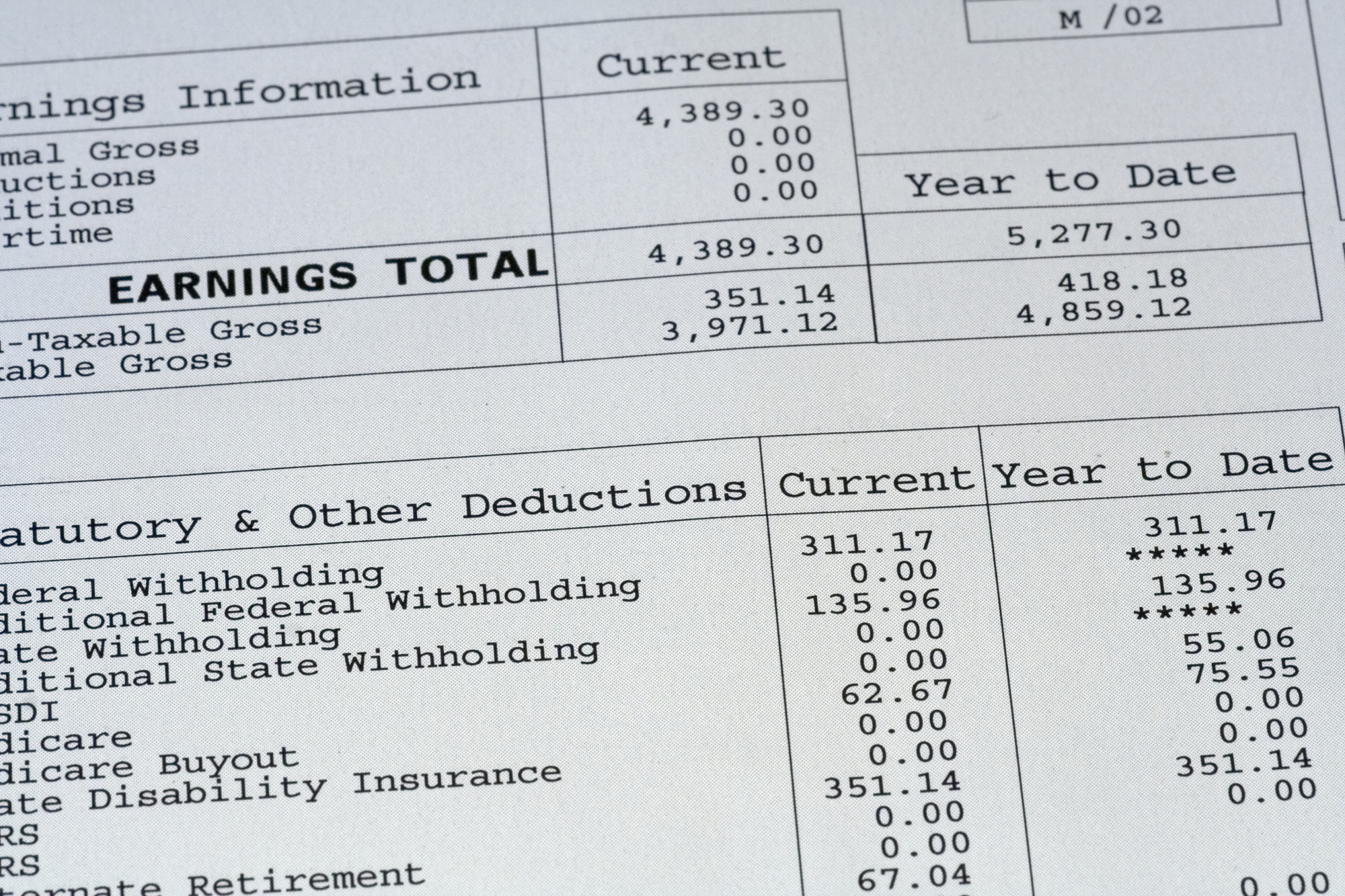

The stub must provide both an itemized list of deducted amounts and the sum of all deductions. Exempt from Federal. 2022 W-4 Help for Sections 2 3 and 4.

While increasing your retirement account savings does lower your take home pay it also lowers your Federal income tax withholding. The federal withholding taxes are not calculating for some of our employees. Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Oklahoma paycheck calculator.

Instead you fill out Steps 2 3 and 4 Help for Sections 2 -- Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit. Upcoming Guidance for January 2023 and January 2024 Editions. A pay stub should also list deductions for both this pay period and the YTD.

Switch to Oklahoma hourly calculator. Federal Filing Status of Federal Allowances. 401k403b plan withholding This is the percent of your gross income you put into a taxable deferred retirement account such as a 401k or 403b.

2022 W-4 Help for Sections 2 3 and 4. This tech very helpful and had me download the IRS calculator excel worksheet. If you have a household with two jobs and both pay about the same click.

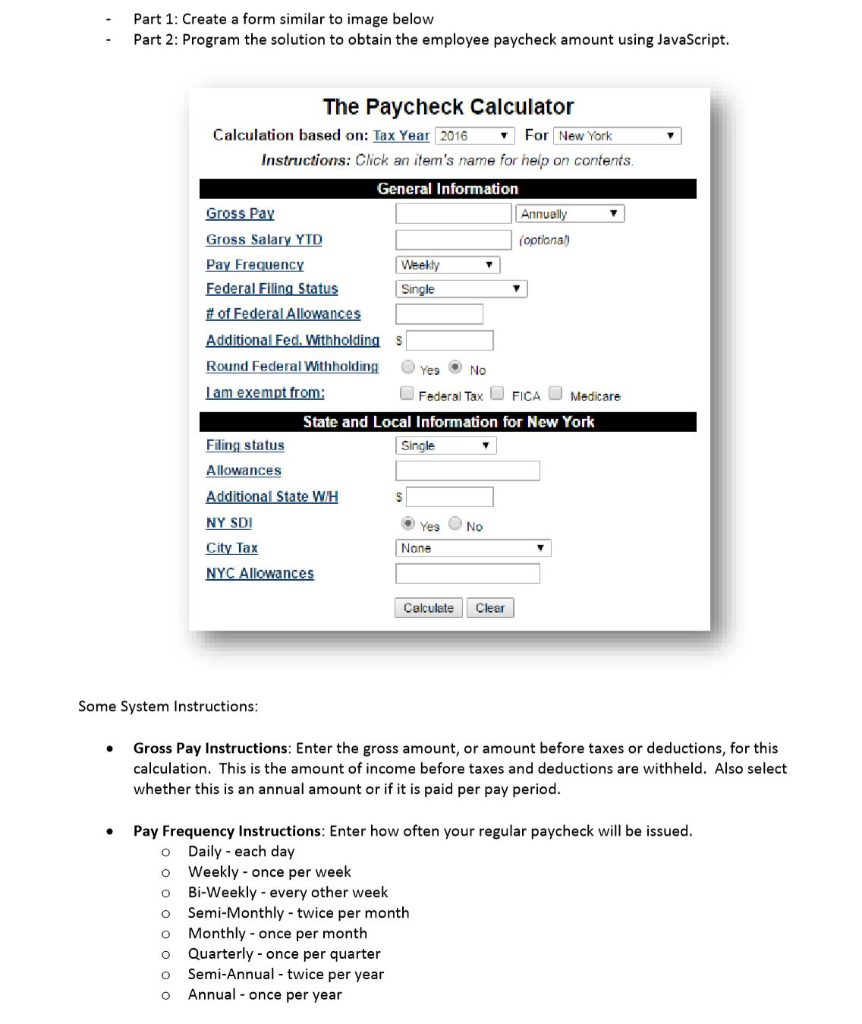

On March 3 2022 the Governor General in Council on the recommendation of the Minister of National Revenue made amendments to Subsection 100 3. Switch to Washington hourly calculator. Free Federal and New York Paycheck Withholding Calculator.

Common deductions include federal tax state tax Medicare and social security. And the formulas in this guide for withholding starting with your first payroll in July 2022. 0 Cheer Reply Join the conversation.

Us Enter Year To Date Ytd And Current Amounts Wagepoint

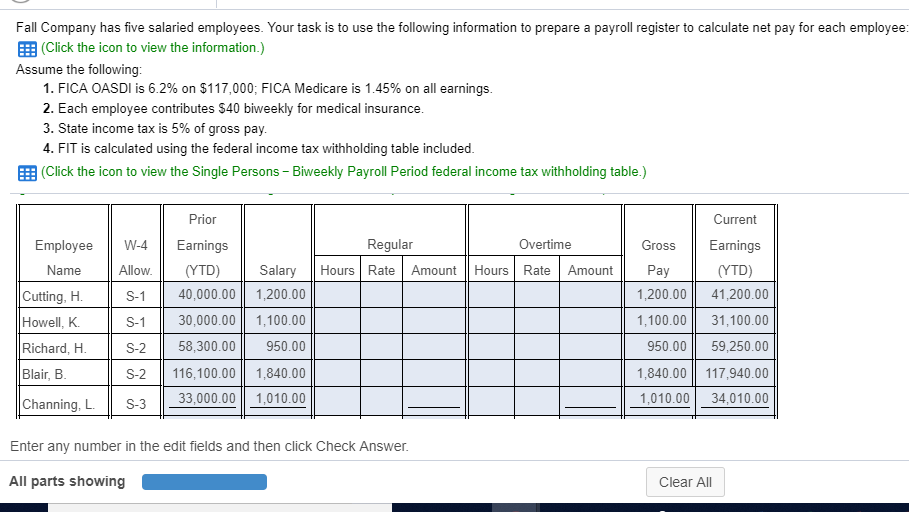

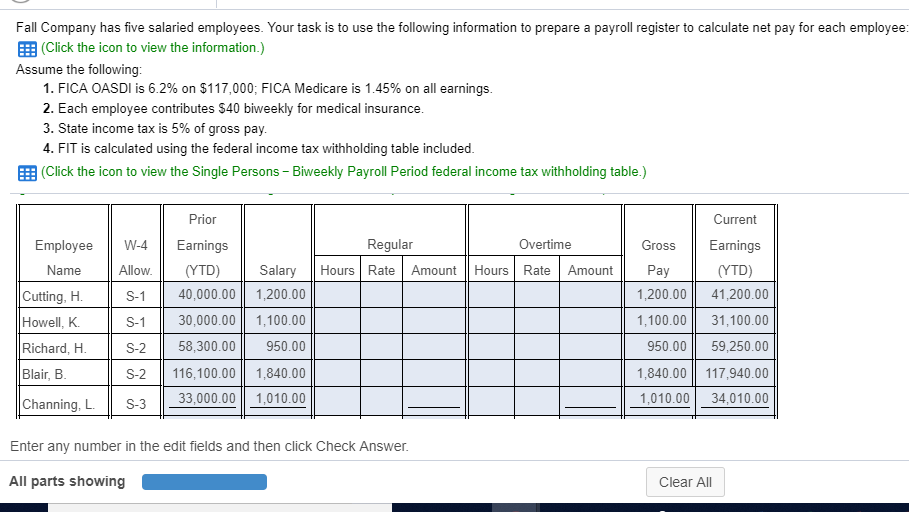

Fall Company Has Five Salaried Employees Your Task Chegg Com

Payroll Taxes Aren T Being Calculated Using Ira Deduction

What Does Ytd On A Paycheck Mean Quora

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube

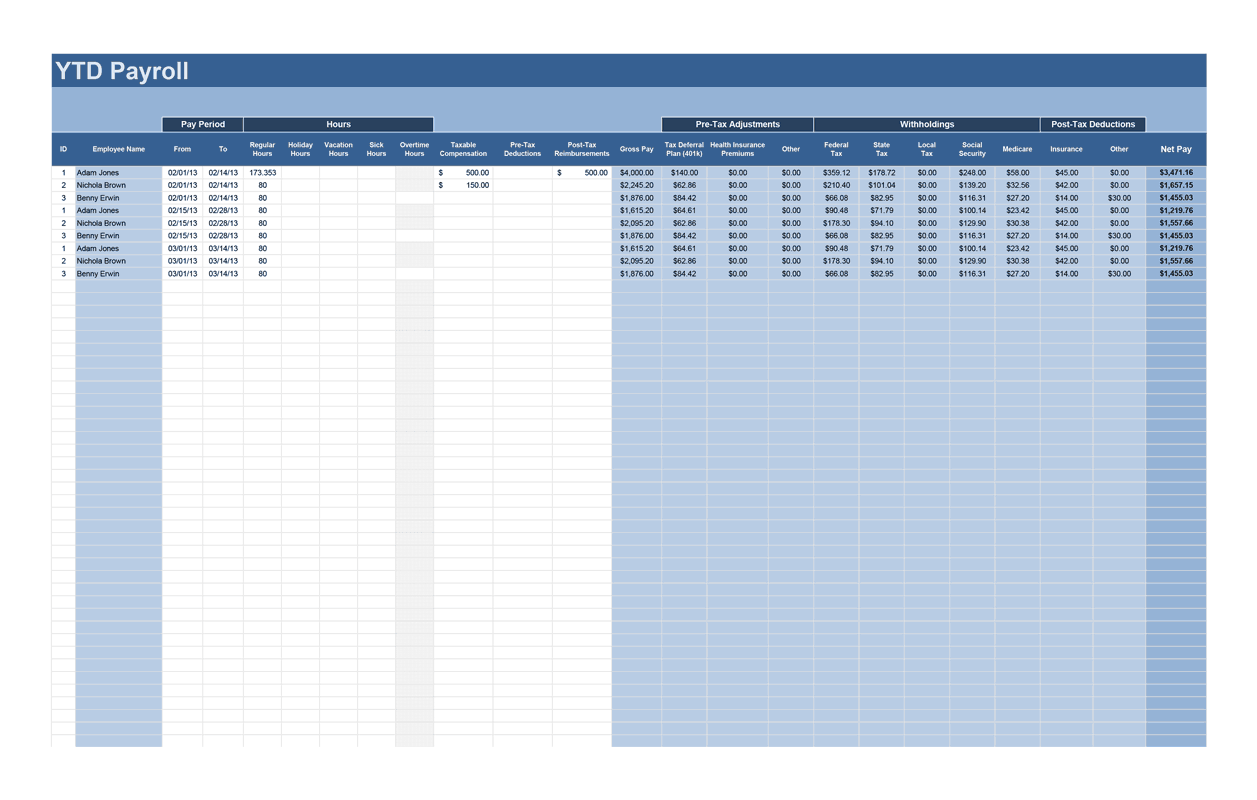

Payroll Calculator Free Employee Payroll Template For Excel

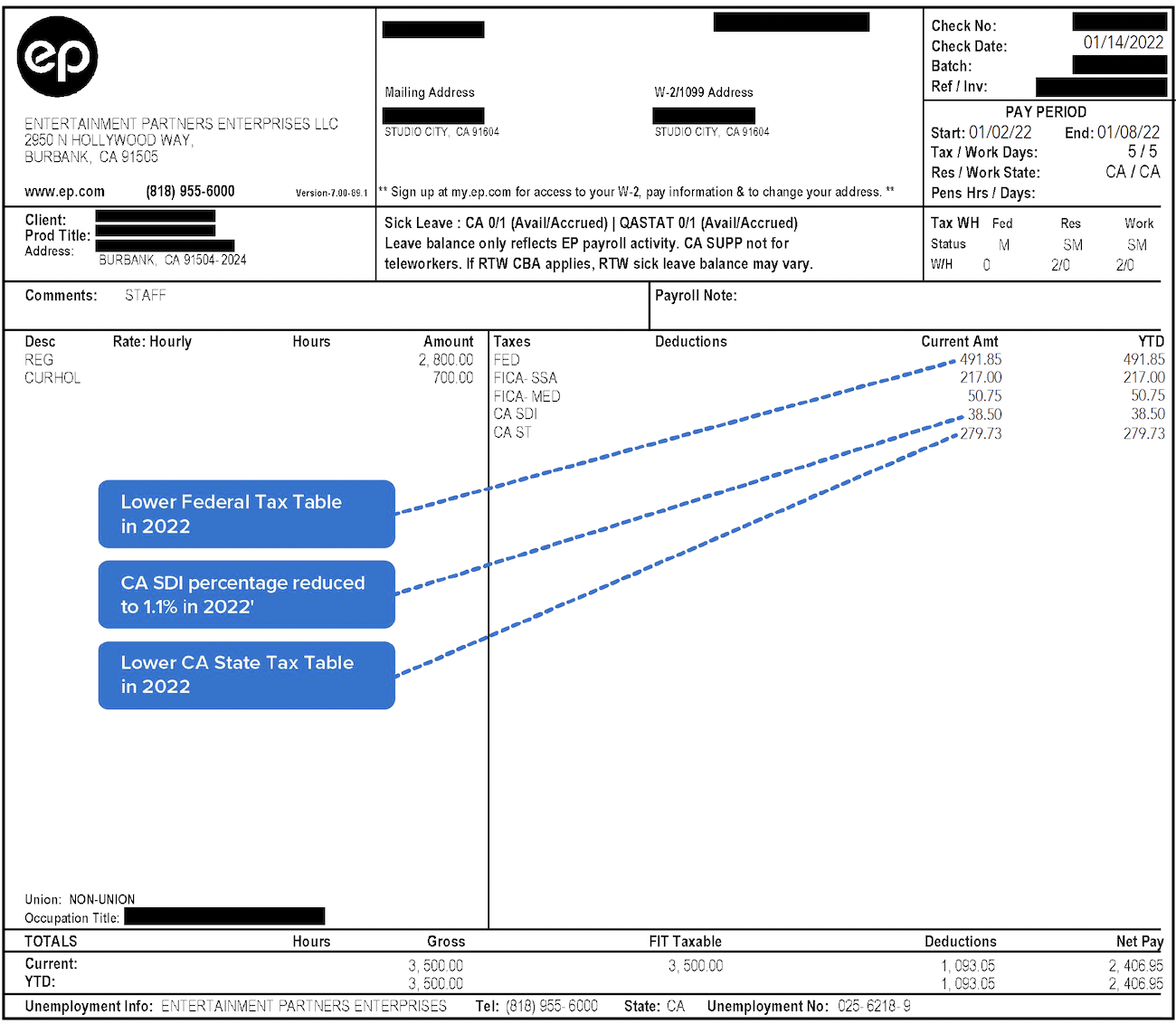

Decoding Your Paystub In 2022 Entertainment Partners

Payroll Calculator Free Employee Payroll Template For Excel

What If Quickbooks Payroll Taxes Are Not Computing Insightfulaccountant Com

So I Use A Website To Calculate The Tax That Should Be Taken Out Of My Checks If I Follow This Should I Be Fine R Doordash

Peoplesoft Enterprise Global Payroll For United States 9 1 Peoplebook

Hrpaych Yeartodate Payroll Services Washington State University

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Oracle Workforce Rewards Cloud 20b What S New

How Do You Get Info Back On Pay Stubs Withholding Status And Allowances Extras No Longer Show On Paystub

Payroll Calculator Free Employee Payroll Template For Excel

What Is A Notice Of Assessment And T1 General Mortgage Brokers Network